The Only Guide to Hard Money Georgia

Wiki Article

The Definitive Guide for Hard Money Georgia

Table of ContentsThe Only Guide to Hard Money GeorgiaGet This Report on Hard Money GeorgiaMore About Hard Money GeorgiaSome Known Details About Hard Money Georgia

As you can see, personal money loans are exceptionally flexible. It could be argued that personal loans can put both the lender and debtor in a sticky situation.

Despite them requiring to satisfy particular criteria, personal financing is not as managed as hard money car loans (in some situations, it's not regulated at all).- Experienced investors know the advantages of matching their exclusive cash sources with a tough cash loan provider.

The Buzz on Hard Money Georgia

Nevertheless, over all, they're accredited to lend to investor. Because of this, they're typically a lot more experienced in fix and turn design financial investments than your ordinary exclusive cash lending institution. Perhaps a slight con with a tough cash lender connects to one of the features that links exclusive and hard cash car loans guideline.Depending on just how you look at it, this is also a toughness. It's what makes hard cash loan providers the more secure choice of both for a very first time financier as well as the factor that smart capitalists continue to decrease this route. WE LEND PROVIDES An ARRAY OF PROGRAMS TO SUIT EVERY KIND OF RESIDENTIAL REAL ESTATE INVESTOR.

The Facts About Hard Money Georgia Revealed

It's usually possible to get these kinds of car loans from private loan providers that do not have the exact same needs as standard loan providers, these personal lendings can be a lot more pricey and also less beneficial for consumers, since the danger is much higher. Traditional loan providers will certainly take a complete consider your entire financial situation, including your income, the amount of financial obligation you owe other lending institutions, your credit score history, your various other properties (consisting of cash money books) and the dimension of your deposit.

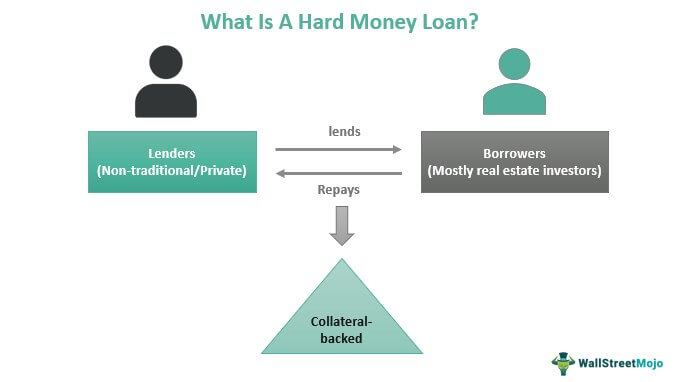

Tough cash fundings have numerous benefits over service car loans from banks as well as other mainstream lending institutions. Are hard money loans worth it? Under the right conditions absolutely.Fast financing can be the distinction in the success or failing of a possibility. Tough cash lenders can turn a car loan application right into available money in an issue of days. Do hard money loan providers inspect credit rating? Yes, yet they concentrate on security most importantly else. They do not review a debtor's credit history worthiness likewise as even more controlled sources of funds. Reduced credit history and also some unfavorable marks in debtors'economic backgrounds play a smaller function in the lending institution's authorization decision. In instance of default, the loan provider has to be ensured that the proceeds from sale of the residential or commercial property will certainly be sufficient to recoup the lending's unsettled principal balance. Somewhat, even the borrower's ability to repay the car loan throughout the term is lesser than various other determining aspects. Nonetheless, the lending institution should make sure the customer can make the required settlements. Fewer state and government legislations manage difficult money lenders, which permits this adaptability. Yet, due to the Dodd-Frank Act, tough money lending institutions normally do not offer for the purchase of a key home. Difficult money finances are a sort of alternative financing

that can be made use of for genuine estate financial investment possibilities. Unlike standard car look at here now loans, which are provided by financial institutions or other economic organizations as well as are based mostly on the borrower's credit reliability and also revenue, difficult cash lendings are issued by personal financiers or companies as well as are based primarily on the value of the residential property being used as security. It uses the debtor a choice to the typical home mortgage programs or traditional lending institutions. One of the most common use these fundings are with solution & flips and short-term funding demands. The difficult money car loans that we supply are raised through tiny individual investors, hedge funds, as well as various other exclusive establishments. Due to the fact that of the risk taken by the lending suppliers, rate of interest are normally greater than the typical residence lendings. Our products have much shorter terms and are typically for 6 months to 5 years, with passion only options and also are not suggested to be a lengthy term financing option. Personalized Home Loan Hard Money Finance Programs Include the adhering to primary program: 1-4 System Residential Feature consisting of Condos, condominiums, house residences, as well as various other special residential properties. This is because hard cash lending institutions are mostly focused on the worth of the home, instead of the debtor's credit reliability or revenue. As an outcome, hard money lendings are often utilized by actual estate financiers who need to safeguard financing rapidly, such as when it comes to a fix and turn or a short sale. This consists of single-family houses, multi-unit buildings, industrial homes, and also even land.

Some Known Details About Hard Money Georgia

Furthermore, hard money finances can be made use of for both acquisition and refinance purchases, along with for building and construction and also improvement projects. While difficult money car loans can be a helpful device genuine estate investors, they do include some disadvantages. In spite of these downsides, hard cash financings can be a valuable device genuine estate capitalists. If you are considering a tough cashcar loan, it's crucial to do your research study and also locate a trustworthy lender with competitive prices as well as terms. Additionally, it is essential to have a clear plan in location for exactly how you will use the financing profits and exactly how you will certainly exit the investment. Finally, tough money finances are a sort of alternate financing that can be utilized for real estate financial investment possibilities. They are issued by personal investors or firms and are based largely on the value of the home being used as collateral. Among the major benefits of hard cash financings is that they can be gotten promptly as well as easily, typically in as little as a couple of days. Difficult cash fundings normally have higher interest rates and also costs than typical loans, as well as have much shorter terms. Consumers must very carefully consider their choices and have a clear strategy in place prior to devoting to a hard money lending. These lendings are suitable for individuals that are credit scores damaged. This is because, as long as you have great collateral, the hard lending lenders will certainly offer you a loan also if you are bankrupt. The financings are likewise perfect for the foreign nationals who will certainly not be given loans in other organizations since they are non-citizens of an offered nation. One fantastic advantage is that weblink the fundings are less complicated to access; for that reason, if you do not fulfillthe certifications of the traditional lending institution, you can quickly access the lending without going through strenuous paperwork. These lenders offer actual estate capitalist finances alongside the speed and ease benefits that difficult cash provides, however with even more trustworthy closings and better transparency as well as solution through the process. Exclusive lenders usually have much more resources to release and also extra dependable access to funding than difficult money loan providers. These are two substantial reasons that financiers thinking about hard cash needs site here to investigate exclusive lending institutions and also specifically.( Last Updated On: June 1, 2022)There are numerous financing alternatives for real estate capitalists readily available today. Among one of the most popular options has ended up being the tough money finance. A difficult cash financing is a financing collateralized by a tough possession (most of the times this would be realty).Report this wiki page